If you have any questions do not hesitate to contact me at intentionallyinspired@gmail.com.

Have a great day and be intentional..

Here are some notes from the scope.

Kristin Zolkowski

https://www.facebook.com/kristinjalowieccastellano

I live in

Wisconsin, Wife mom of 4 2 adults 2 teens that think they are adults. I have

been in business since 1996, Moving business, Sign Business (4-6 employees)

Bookkeeping, concierge, in home daycare center, cleaning, desktop publishing,

logo design. Moved in June to a small farmhouse. I just cut off the last of my

clients letting them know I would not be doing their taxes this upcoming

season. I am not up to keep up with the ever changing laws J

Except for whoomyself..

Approaching this as though you know nothing. Sorry if some of this

sounds very basic but believe it or not some people are not fully aware of the

most basic IRS rules and since the laws are changing from year to year tax

preparers are now required to obtain a certified license for preparing taxes in

an office.

When you decide that your blog or other business is ready to become

more than a hobby per the IRS, there are a few things you need to consider;

Business Structures, DBA, yes

Business or hobby ??

The IRS will not allow

tax deductions if your business, be it blogging or any other business is

categorized as a hobby. To claim your deductions, you must first show the IRS

that you are running a legitimate business that is generating a profit 3 out of

5 of the most recent years. Some Other things the IRS may might look at is the

amount of time and activity that you put into your business and whether or not

you depend on income from it and does it how profit potential.

Estimated Taxes are Due April

15, June 15, September 15 and January 15 (with some exceptions for holidays,

etc.). If you don't pay your estimated taxes in a reasonable timely manner, you

may owe an additional tax penalty.

What you are calculating is the amount you must pay for

self-employment tax on your income, which is the combined Social Security and

Medicare taxes paid by an employee and an employer. Because you run your own

business, you required to pay both the employee and the employer portions.

Self-employment tax must be paid whether or not you owe any federal income tax.

Self-employment

tax when you are putting money aside for your estimated income

taxes, don't forget to set aside additional money for self-employment tax. From

the perspective of the IRS, working as a blogger means you run your own

business and that your income from that income is taxed.

Keeping

Track of Expenses: I cannot stress enough how

important Good record keeping is. I was audited by the Irs years ago. I made

several costly mistakes but I was forgiven of those mistakes with a warning by

the IRS, solely based on the fact that I kept my paperwork extremely organized.

They were able to wiz through thousands of receipts and expense. This was much

better than dropping a load of jumbled receipts on their desk and expecting

them to calculate them.

Ideas for

keeping track of expenses and deductions: There is a giant Plethora of options

for keeping track of expense ranging from simple excel spreadsheets to $400 +

accounting programs where Programs like Quickbooks, Peachtree and Quicken Etc.

Quickbooks hands down is probably, still, after all these years the consumers

choice. (Side note: Keep a small ledger in car to keep track of business

mileage. The Irs will ask if you keep track of your mileage. )

I cannot stress

enough!! Keep receipts, keep them in categories. Print them, ask for them, and

get them. (Stubs, PayPal receipts, emails

etc.)

a special tax rule allows you to deduct

up to $5,000 in start-up expenses the first year you are in business, and then

deduct the remainder, if any, in equal amounts over the next 15 years.

For

an expense related to your business to be deductible, it needs to be both “ordinary” and “necessary”. No matter

what industry you are in, that is the standard for the IRS. So, any

time that you question whether something is deductible, as a first step, ask

yourself is this “ordinary” and “necessary”?

An ordinary expense is one that is common and

accepted in your industry. It’s the one time that you care about what your

competitors are doing. No matter what your mother says, it does matter whether

everyone else is doing it, too.

A necessary expense is one that is helpful and

appropriate for your trade or business. You don’t have to prove that you

couldn’t be in business without the expense – more or less, it needs to make

good business sense.

You’ll need to retain excellent records with annotations

about the expenses

Always check with a tax

professional if you are unsure if something is or is not deductible. Call IRS

during tax season or check out the interactive tool at

Deduction Categories: (remember to err on the side of caution when

it comes to the IRS and only deduct the business portion of items you are

claiming.)

Corporation

incorporates fees. Advertising & Marketing (Head

Shots, promotional materials, advertising spots on other blogs, business cards,

signs, printable, flyers, ad spots, newspaper spots or advertisements, Logo

design etc.)Trademark and copyright fees, Depreciation (Long-Term

Assets Long-term assets are things you purchase for your business that will

last for more than one year,(must be used more than 50% for business such as

computers, office equipment, cars, and machinery. Long-term assets you buy

before your business begins are not considered part of your start-up costs.

Instead, you must treat these purchases like any other long-term asset you buy

after your business begins: You must either depreciate the item over several

years or deduct the cost in one year under Section 179. However, you can’t take

depreciation or Section 179 deductions until after your business begin.)Office Supplies (Tax software, Accountant, Tax prep etc, paper, printing, ink, pens

etc.) Postage, PO

Box, Materials and supplies to create a post that

makes you money (including shipping if applicable), Prizes, Gifts and

giveaways. If you make the gift you can only deduct

the cost of creating the item, for example I make bath salts and sell them on

etsy. I can deduct the cost; let’s say 2 dollars that I paid to make the bath

salts. NOT the full retail value. Vehicle, travel and meal expenses (blogger meetups, small business seminars and blogging conferences) any

sort of Education related to your business (including but not limited to eBooks, courses,

seminars etc.) ANYTHING

Downloaded for business purposes, Costs and expenses to run your blog (Domain name, Webhost, Logo Design, Web templates, WordPress plugins and

costs, Cost of contractor to help you, Internet Fees and Phone Fees as well as

cell phone fees. If you use the cell for personal you figure a percentage to

deduct for business. Let’s say you pay 100 a month and use your phone 50% for

business then you can deduct $50 a month for cell phone fees as well as

additional app charges related to your business. Digital Cameras, Design Software, memory cards or other

peripherals and or equipment. Dues and Subscriptions, Paid websites for

subscriber newsletters etc like mailchimp,

Equipment, Material and supplies used solely for the purpose of

creating an engaging blog post; here are some examples: http://www.taxgirl.com

- Your

blog is a baking blog and you make a full course meal, soup to nuts. Is

it deductible? Perhaps the cost of the sourdough bread is … but not

the rest of the meal.

- Your

blog is a baking blog and you make three loaves of sourdough bread. Is

deductible? Probably the cost of one loaf – that’s the part you needed

for your review, right? But not three. The other two are likely to be

eaten for personal use and are not deductible.

- Your

blog is a general food blog and you make lasagna for your entire family. Is

it deductible? Maybe. If your blog is a “family food blog”, then

perhaps the family-sized portion is deductible. If your blog focuses

solely on a niche, like healthy eating or cooking with noodles, then only

the portion attributable to you, for the purposes of testing, is

deductible.

Business Use of Your

Home' Not a fan of this. It’s a red flag for IRS If you use part of your home for your business,

you may be able to deduct expenses for items such as mortgage interest,

insurance, utilities, repairs, and depreciation. To qualify you must meet the

following criteria:

a)

The business part of your home must be used exclusively and regularly for your

trade or business. However, there are exceptions for daycare facilities or

storage of inventory/product samples.

b)

The business part of your home must be:

-

The principal place of business, or

-

A place where you meet or deal with patients, clients, or customers in the

normal course of your business, or

Some Apps that I came across to help you are (Software

programs Quickbooks, Peachtree, Quicken)

AndroMoney FREE

Expense Manager by Bishinews FREE

Concur

Small Business Accounting Pro

FREE

Daily Expense FREE

Book Keeper Accounting and

Invoice FREE

Real Quick I was asked “If I am

sent a product for review is this taxable” Right now there is not a lot of

information from the IRS indicating the specifics on this. If you make money

generated because of doing this review my answer will be yes you may need to

count it as income. Sorry.

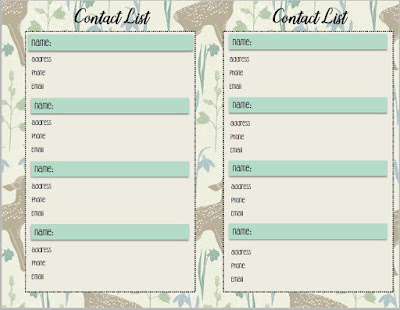

Click on Arrow For printable

Full Notes(Click On Arrow)